Introduction

Bubbles are something that every developed, developing and under developed economy has faced over the years all around the world. A bubble is an escalation of prices of assets based on speculation of the future value, the price reaches a level higher than the artistic value of the commodity itself. When the bubble reaches the epitome, depending on the nature of the bubble, various reason causes prices to crash and the bubble to burst causing sever economic distress in terms of income loss and sharp fall in value of output.

Past and History

Some of the major bubbles in the history of financial economic history are the Mississippi Bubble which was a financial policy that led to a speculative mania created by John law who with his influence and relation with France royalty and government established banquet d’generale and campaign d’ occident, with the bank having the authority to print money and manipulate supply law was extremely power full, his scheme to dispose public debt by selling his shares for state-issued

public securities instigated speculation frenzy which led to a stock market boom and subsequent crash ,The South Sea bubble was a similar bubble that subsequently took place in France, Tulipmania the financial crisis when the tulips started being purchased at unimaginable amount and pushing prices to unprecedented heights with the price of a single tulip exceeding annual income of general workforce . The crisis around the tulips were caused because of the hype of the product of beauty and of up market significance more than anything else and immediate acceptance by the wealthy as a flower fit for the most stylish garden increasing its demand as a societal standing. The primary cause of bubbles is usually accelerated speculation, when central bank creates surplus. Credit , the excess money in the market causes speculation, this sudden surge in money supply causes movement in interest sensitive segments of the market like the housing sector.

Indian Real Estate

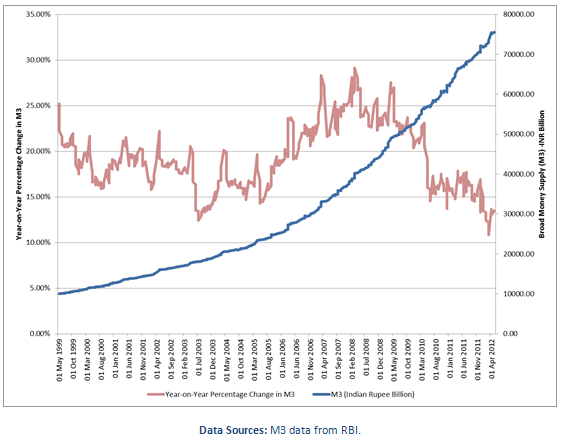

India in the recent past faced the real estate housing bubble , this bubble has been rather been a long one , consistently pumped over a long period of time. Decade long, fundamentals defying rise of the value in the real estate sector, an approximate of 5x-6x increase in various regions all over the country. First of all the debate is about the rise in price being a bubble at all ,my argument is for the price rise being a bubble due to following reasons , the price rise in the previous decade for metropolitan city (for easy analysation) has remained Constant with very few fluctuations, only in Bangalore the bubble affected in a way where the supply of real estate increased so, the price did not shoot up, the gross rental yield 2.68 percent in majority of metropolitan city which are the among the lowest yield of entire of Asia, asset prices which are not coordinated with yield are the most classical sign of a emerging bubble, the bubble has escalated at such a pace because of the rapid monetary injection in the economy by the RBI , abundant availability and access of credit often inflates the bubble.

Crash

The major argument on as to why the bubble may not crash is the increase consumption of luxurious goods but this could be opposed strongly ,firstly because consumption cannot be used as indication of sustainable economic growth , growing economy is the one that higher production of commodities and not consumption and also when there is increased inflation in the economy , the

net worth of the existing rich class increases as asset prices shoot up leading to increased consumption as chain reaction. The crash can also be viewed as a benefit to the economy because after the crash the prices fall to pre-boom levels or lower levels but the damage it cause to public in terms of lost income, investment and welfare is an extremely high price to pay for the benefit of fall

in rates. The major trigger to a crash is when the money cannot inject money anymore and there is a slow down of money supply in the economy, leading to price crash and popping of the speculative bubble in the economy.

Banking Sector

Every bubble is affected by the banking bank sector in both the negative snd positive aspects but the bursting of a bubble has the most severe implication of destabilising the entire banking sector in terms of exposing the market to overvalued asset prices and increased rate of borrowing which after the crash, the borrowers are unable to keep up with. Economic collapses after a bubbles

faced by various countries have nearly always been led by the banking sector, in such a scenario of distress, the government usually steps in and bails out the banking system by taking up the debt and strategising repayment in attempt to stabilise the economy.

Inference and Conclusion

The bubbles are caused to herd behaviour, mania and unreasonable speculation, moral hazard ,comparison with historic data but the ability of asset prices to be inflated beyond imagination is what causes the economy to collapse, which can indeed be controlled but never prevented as the speculation can arise from any cause or source. Bubbles are usually caused due to non-fundamental factors in case of housing genuine increase in savings over a considerable period of time is a fundamental cause for increase in prices but inflation caused due to increase in supply of money causes speculation proves the rise to be a bubble. The crash often leads to bail out by the lender of last resort which is either the government in terms of domestic bail out or super power countries in the country decides to avail global help, bubble are inevitable but if controlled well the damage can be reduced from mediocre to minimal.

References

Allen, F., & Gale, D. (2000). Bubbles and Crises. The Economic Journal, 110(460),

236-255.

Retrieved from http://www.jstor.org/stable/2565656

Newell, G., & Kamineni, R. (2007). The Significance and Performance of Real Estate

Markets in India. The Journal of Real Estate Portfolio Management, 13(2), 161-172. Retrieved from http://www.jstor.org/stable/24883076

BUBBLE IN THE INDIAN REAL ESTATE MARKETS: IDENTIFICATION USING REGIMESWITCHING METHODOLOGY Vijay Kumar Vishwakarma, St. Francis Xavier

University Ohannes George Paskelian, University of Houston-Downtown

RESERVE BANK OF INDIA DATA SOURCE

https://dbie.rbi.org.in/DBIE/dbie.rbi?site=home